|

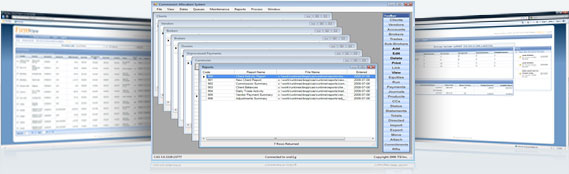

Supporting soft dollar, commission recapture, directed brokerage, commission sharing arrangements and numerous other commission management services, CAS has become an industry standard in the institutional brokerage arena over the past two decades. CAS is designed in a modular fashion so that Institutional Broker/Dealer clients can add functionality as their business grows and regulatory requirements evolve. TSI’s Commission Allocation System(CAS) software is currently running commission management programs around the world. Our clients include some of the world’s largest brokers, running global programs, as well as small local boutiques. CAS allows for tracking, managing, reporting, all related transactions as well as integrating with internal accounting and reporting applications. As an open data base product, CAS is capable of producing a variety of internal management reports in addition to its support for tracking, reporting, and managing all trade, payment and journal transactions. TSI is experienced at designing comprehensive client, vendor and plan sponsor statements. As the commission allocation industry has developed and matured, TSI has created additional functionality to meet the need to automate the services as much as possible. CAS can be implemented to run a single database running locally or globally or multiple databases located around the world. If the need exists most likely we have already designed and implemented it. Combining CAS with our Firmview invoice payment approval module provides a cost effective end-to-end automated solution for managing the soft dollar function. TSI’s customized solutions can often be implemented in 4 to 6 weeks. Depending on your internal IT standards, CAS can operate with Oracle, SQL Server or Sybase databases. CAS is available in both a client/server version as well as hosted online in an ASP version. Typically, larger installations choose the client/server software. Smaller commission management operations may opt for the outsourcing benefits of the ASP version of CAS. This version is hosted online by TSI but appears as an application on the broker's desktop. The ASP version allows you to outsource the IT support and provision of IT infrastructure while offering CAS at a lower entry price. Using the ASP version of CAS combined with Firmview would allow a broker to completely outsource their commission management function. Our consulting staff is also actively involved in providing direction on organizing workflow and implementation of a commission allocation program.

CAS and Firmview work together to create a complete solution to your commission managment needs. CAS resides internally within your brokerage systems (or securely hosted at our server farm if using our ASP option) in order to perform the robust tasks of processing trades, computing trade credit, interfacing with your accounts payable department and producing statements. The data and screens of CAS cannot be seen by a buy side client. Firmview serves as the communication layer to CAS. As such, vetted information is securely posted to the Firmview portal in a structured manner. As a collaborative portal, the client is able to review and interact with the brokers’ posted information. Through automated updates between CAS and Firmview, buy-side and sell-side users are able to communicate in a structured manner across these two systems. |

|

About

About

Features

Features

Working Together

Working Together